How to take on more clients confidently: With compliant AI for financial planners

Author

Ben Glass

Published

Dec 16, 2025

Read time

7 min read

Every adviser dreams of saying "yes" to that next client with zero hesitation. But here's the uncomfortable truth lurking behind every growth opportunity: can your infrastructure handle an increase in capacity?

Between 2017 and 2022, firms added 1.1 million new ongoing clients whilst adviser numbers increased by only 3,000. The blockage is operational capacity to deliver compliant, high-quality advice at scale under intensifying Consumer Duty pressure.

This is the capacity paradox: advisers receive more referrals than they can confidently onboard because each new client relationship doesn't just add revenue, it compounds the administrative and compliance burden exponentially.

AdvisoryAI, the right AI for financial planners, can fix this paradox. Before getting there, let’s get more into the topic.

The capacity paradox every adviser faces

Even with longer hours, harder work and more stress, your capacity would not reach the demand. Its growth lies in infrastructure. It's about having systems to prove ongoing suitability for every client relationship whilst maintaining service quality and regulatory confidence.

These costs are the reality of Consumer Duty implementation, the price of maintaining comprehensive audit trails, and the expense of ensuring every suitability report meets FCA standards.

Consumer Duty fundamentally changed the growth equation. Every new client is more than just revenue potential. They represent an additional commitment to demonstrate ongoing good outcomes, maintain detailed documentation, and prove fair value continuously. The FCA's 2024 review of ongoing advice found that while suitability reviews were delivered in around 83% of cases, firms must now evidence systematic delivery rather than best-intentioned promises.

The real cost of "Just one more client"

When advisers say they're at capacity, they're rarely referring to client meetings. Most advisers love client-facing work. They're referring to what happens after the meeting ends:

Reconstructing conversations into compliant meeting notes (1-2 hours per client)

Writing suitability reports that consume 4-7 hours each, with 71.9% of advisers spending between one and seven hours on a single report

Updating CRM systems manually across fragmented platforms

Paraplanners chasing advisers for clarifications because meeting notes lacked essential context

Conducting compliance checks that generate a lot of doubts before being confident

Managing the psychological weight of knowing FCA audit readiness depends entirely on whether you remembered to document everything correctly

Advisers and paraplanners spend 10-15 hours each week on suitability reports alone, representing nearly 40% of the working week consumed by documentation.

The real cost of this is opportunity loss. Every hour spent wrestling with reports and compliance anxiety is an hour not spent building relationships, providing strategic advice, or serving additional clients who need guidance.

Automation alone is not enough

The allure of automation promises is attractive: "Generate reports in minutes!" But here's what generic automation actually delivers: faster mediocrity.

Speed without compliance and confidence is dangerous. Speed without proof of ongoing suitability is liability in a convenient package. Speed that produces outputs requiring three hours of manual checking and reformatting hasn't actually saved anything except the initial keystroke time.

Compliance workflow automation built on principles and systems that produce suitable advice is what gives us faster excellence.

The compliance reality: Faster isn't better if you can't trust it

Under Consumer Duty, firms' boards are responsible for assessing whether they're delivering good outcomes for customers, with the expectation that compliance focus receives the same ongoing attention as financial performance or risk management.

This means advisers double-check everything, even automated outputs, because the consequences of missed compliance are career-ending. The FCA doesn't accept "my software got it wrong" as a defence. The responsibility remains yours, regardless of which tools assisted the process.

Generic AI for financial planners creates a dangerous illusion: the appearance of efficiency without the substance of compliance assurance. Advisers still perform manual quality checks, still cross-reference COBS requirements, still lose sleep wondering whether section 4.7 adequately demonstrates suitability for Mrs Thompson's pension consolidation recommendation.

What decides capacity isn’t "how fast can I produce a report?" but "how confident am I that this report will withstand FCA scrutiny while genuinely serving my client's best interests?"

You need confidence in the process AND the outcome

Here's the uncomfortable truth about scaling advice businesses: infrastructure confidence matters more than raw output speed.

Firms that successfully scale are building systematic processes where:

Every client interaction is captured comprehensively (not just transcribed, but structured for compliance and paraplanner use)

Report generation maintains quality while accelerating (not templates stuffed with generic content, but intelligent systems understanding regulatory requirements)

Compliance checking happens in real-time (not after-the-fact panic reviews, but ongoing assurance built into the workflow)

The firms scaling successfully are looking for more than just measuring "time saved per report." They're measuring confidence gained per client relationship.

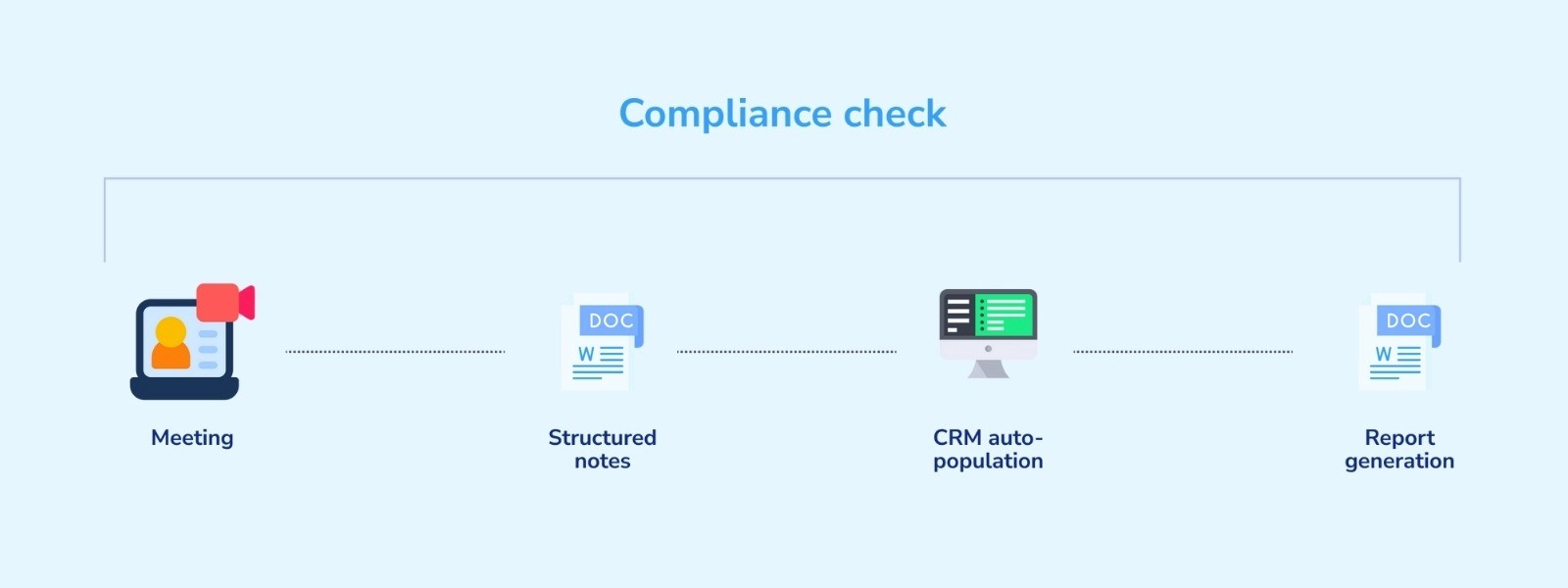

And that’s exactly what AdvisoryAI brings to you. Compliance is built into every stage of the advice automation process.

Let’s get into how compliance confidence is a big chunk of time consumer and how AdvisoryAI can help solve it.

The psychological burden of scaling without confidence

There's an invisible cost to capacity constraints that financial metrics never capture: adviser anxiety.

When you're unsure whether your documentation proves ongoing suitability, every new client relationship feels like a potential future liability rather than a growth opportunity. When you know your paraplanner is drowning in ambiguous notes and fragmented data, recommending another client feels irresponsible rather than entrepreneurial.

11% of advisers are considering leaving the profession due to increased pressure and costs associated with meeting Consumer Duty requirements.

Confidence in your compliance infrastructure changes everything. It transforms growth from "can we possibly handle this?" to "who else can we serve excellently?"

The three foundational layers for scalable capacity

Successfully scaling advice capacity requires more than good intentions, hard work, and late nights. It demands a systematic infrastructure across three interconnected layers.

Layer 1: Compliance built into the automation

Compliance cannot be something you "do" to a report after writing it. Real compliance confidence comes from systems where regulatory requirements are embedded as a foundational structure.

The FCA expects advice suitable for each client's risk profile, complete documentation of suitability, recording of material changes, and evidence of corrective actions when circumstances evolve. The regulator's 2024 review found that whilst 83% of suitability reviews were delivered, firms must now demonstrate systematic delivery rather than best-efforts promises.

Real-time compliance assurance fundamentally changes how firms operate. Imagine systems that flag compliance issues during creation.

What compliance built into automation actually looks like:

Traditional compliance approach | Compliance-in-automation approach |

Write report, then check compliance | Compliance rules guide report structure from inception |

Manual cross-referencing against COBS | Automated real-time checking with pass/fail verdicts |

Adviser anxiety about whether coverage is adequate | Systematic confidence through comprehensive checking |

Rework cycles consuming hours | Issues identified and resolved during creation |

Compliance as final-stage bottleneck | Compliance as workflow accelerator |

The difference is the distinction between spending three hours checking a completed report versus spending 15 minutes addressing flagged issues during drafting. It's the confidence to tell clients "your report is ready", knowing your automation helped you with compliance, too.

Our Colin starts scanning from the moment his AI colleague Evie gives post-meeting documentation from the meeting recording

Layer 2: Outputs trained to your firm's standards and templates

Here's where most automation spectacularly fails: generic outputs that nobody actually uses without extensive manual reformatting.

The true time drain is the post-generation reformatting, brand alignment, tone adjustment, and structural reorganisation required to make generic outputs actually usable for client delivery.

Think about the process most firms endure:

Use automation tool to "generate" initial draft

Spend 90 minutes reformatting to match firm templates

Rewrite sections that don't reflect firm's advice philosophy

Adjust tone from "corporate robot" to "trusted adviser"

Restructure sections to match compliance team's preferred format

Add missing soft facts and client-specific nuance automation missed

Question whether automation actually saved any time

First-draft confidence emerges when systems understand your firm's unique voice, structure, and compliance framework from day one.

This means:

Reports emerge pre-formatted to your exact template specifications

Language reflects your firm's communication style automatically

Compliance requirements align with your specific interpretation and house rules

Structure matches what your compliance officer expects without prompting

Soft facts and client context are preserved, not stripped for efficiency

When done properly, "first draft" becomes "review draft," not "rebuild draft." And that's genuine efficiency for you.

AdvisoryAI makes sure that automation looks like a faster version of you. With firm-specific template adaptation, advice tone, and its ability to understand different UK dialects, we personalise automation.

Layer 3: Workflow that ends data-chasing and fragmentation

The administrative nightmare doesn’t lie in report writing alone. It's also in the fragmented data hunt that precedes every report:

Where's the updated fact-find? (Check emails... maybe the CRM... possibly that shared drive folder)

What exactly was discussed in the last meeting? (Scroll through adviser's handwritten notes or transcripts... decipher shorthand... guess at unclear sections)

Has the client's risk profile changed? (Find the last risk questionnaire... compare to current circumstances... hope nothing was missed)

What were the specific investment performance figures? (Log into platform... export data... format for report... pray numbers match other systems)

Every system switch, every manual transfer, every "where is that document?" moment adds minutes that accumulate into hours.

Sustainable scaling requires integrated workflows where meeting capture, CRM updates, and report generation flow seamlessly without manual intervention:

Not as separate manual steps, but as connected automation where each stage feeds the next with zero data re-entry, zero document hunting, and zero "did I update that field?".

Firms successfully scaling capacity eliminated the disconnected workflow that made speed impossible in the first place.

AdvisoryAI’s Evie structures all the data she gets and citations point to where exactly every information is pulled from, singlehandedly solving data chaos.

Questions to ask before you scale

Growth without honest infrastructure assessment is strategic malpractice. Before considering additional client onboarding, every firm should confront these uncomfortable questions:

1. Can your current system demonstrate ongoing suitability instantly?

If the FCA requested proof of ongoing suitability for every client tomorrow morning, could you produce comprehensive documentation within hours rather than weeks?

The FCA's review of ongoing advice found that whilst most firms deliver suitability reviews, the requirement now is systematic evidence of delivery, not best-intentions promises. "We think we're doing it right" is insufficient. "Here's the documented proof for every client" is the standard.

The test: Pick a random client from your book. How long would it take to compile:

Complete meeting history with structured notes

All suitability reports with compliance validation

Evidence of annual reviews completed

Documentation of changes in circumstances addressed

Proof of ongoing service delivery matching fees charged

If the answer is "several hours to several days," your infrastructure isn't doing it right. You need systems that let you confidently scale.

2. Do your admin and suitability processes actually lower risk?

Many firms confuse "doing work" with "lowering risk." The question isn't whether you're producing documentation; it's whether that documentation genuinely reduces compliance exposure whilst improving client outcomes.

Consider:

Are handwritten notes clearer than AI-structured transcripts for demonstrating what was discussed?

Do manually formatted reports reduce errors compared to template-trained AI outputs?

Does spending three hours per report actually improve compliance, or just create the appearance of thoroughness?

Research shows that fragmented systems and manual data entry don't just consume time; they create compliance gaps where details fall through disconnected workflows.

The brutal truth: Overwork doesn't equal lower risk. Systematic infrastructure equals lower risk. Exhausted advisers making manual entries at 9 PM on Friday create more compliance exposure than well-rested teams using validated automated systems.

3. Are turnaround times measured in days/weeks or hours?

Client experience directly correlates with turnaround speed. How long does your firm take from meeting conclusion to delivering the suitability report?

Industry reality for traditional workflows: 7-14 days minimum. Why?

Adviser needs time to write meeting notes & other post-meeting documentation (whenever they find time)

Paraplanner has queue of other reports (first-come-first-served basis)

Adviser review identifies gaps requiring rework (adding days)

Compliance check reveals issues needing correction (more delays)

Leading firms using integrated AI infrastructure: delivering in mere hours (24-48 hours maximum), often same-day delivery.

When prospects compare advice firms, turnaround speed signals professionalism, infrastructure confidence, and client prioritisation.

4. If the FCA requested a full audit tomorrow, would you be confident or worried?

This question reveals everything about genuine infrastructure confidence versus operational anxiety masked as thoroughness.

Confident infrastructure firms think: "We have systematically documented, compliance-checked evidence for every client interaction, readily accessible and organised."

Infrastructure-weak firms think: "We'll need to reconstruct files, chase missing documents, hope handwritten notes are legible, pray we documented everything adequately."

How do you make sure you can positively answer all of the above questions? By integrating AdvisoryAI into your workflow.

Let’s see why we said AdvisoryAI is the only answer you’d need.

AdvisoryAI: The solution built for advice confidence

Only after establishing the confidence layers does technology become meaningful. AdvisoryAI is an infrastructure purpose-built for the specific compliance, capacity, and confidence challenges facing UK advice firms.

Meet your AI Team: Emma, Evie, and Colin

Evie: Meeting Notes & Admin Assistant

Every scalable advice process starts with accurate, comprehensive meeting capture. Evie transforms client conversations from handwritten scribbles into structured, paraplanner-ready documentation

Emma: Report Writing Assistant

Emma generates complete, compliance-ready suitability reports trained specifically to your firm's templates, tone, and regulatory framework

Colin: Compliance Checker

Colin ensures every report meets FCA standards through real-time compliance checking against COBS rules and Consumer Duty requirements. He makes sure compliance workflow automation is actually efficient. He leaves no leaf unturned because if the problem lies in the raw document, what’s the point of building a whole piece of advice on that?

Check out how the platform’s workflow looks as a whole

Compliance and security: AdvisoryAI’s bulletproof approach

Generic AI tools weren't built for regulated financial advice. AdvisoryAI was purpose-designed with FCA compliance and UK data protection as foundational requirements:

Security Infrastructure:

UK data residency: Client data stored on AWS servers within the UK (backup in Ireland)

End-to-end encryption: All data protected in transit and at rest (256-bit minimum)

No training on client data: Firm templates create bespoke configurations; client information never trains shared models

Complete audit trails: Every output cited back to source documents

FCA-aligned compliance checking: Colin's validations reflect current COBS requirements and Consumer Duty expectations

Ready to build real capacity confidence?

AdvisoryAI provides Emma, Evie, and Colin in an integrated, FCA-aligned suite purpose-built for UK financial advisers. Our AI assistants work within your processes, trained to your standards, delivering the systematic confidence required to scale safely and sustainably.

Book a demo to experience how AdvisoryAI transforms advice infrastructure from operational constraint to competitive advantage.

BOOK A DEMO