Emma: Paraplanning software built to keep your advice suitable and compliant

Author

Ben Glass

Published

Dec 16, 2025

Read time

8 min read

Financial advice requires a lot of precision, expertise, and accuracy to satisfy the client. But one foolproof quality that always keeps your client happy is personalised suitability. And, this doesn’t come with templated, generic recommendations.

Here's the uncomfortable truth most paraplanning software companies won't tell you: FCA suitability demands can't be templated away. You can't swap names into pre-written paragraphs and call it personalised advice. The FCA has made it clear that templated objectives don't work for the client, regulator, or ombudsman because they're obviously templated. Consumer Duty requires firms to put customers' needs first and deliver good outcomes, which means every recommendation needs genuine context, not copy-paste compliance.

Every client's story, risk tolerance, and requirements are as unique as their portfolio. The question isn't whether you need to deliver personalised suitability at scale. You definitely do.

The question is how Emma, AdvisoryAI's AI-powered paraplanning software, actually delivers on that standard without drowning your team in admin. Because if you’re onboarding our specially designed paraplanning software assistant for your team, you need to know it stands its ground.

Let's find out.

What Most AI Tools Miss on Suitability

Walk into most advice firms, and you'll hear the same frustration: "We need to speed up report writing, but we can't compromise on quality," and “This AI suitability report generation is just half the race”

So firms turn to "automated" systems. Upload a fact-find, press a button, and out comes a report. Sounds perfect, right?

Wrong.

Most automated report writers are sophisticated mail-merge tools. They swap client details into pre-written templates. Name changes. Numbers update. The structure stays identical.

Every. Single. Time.

Why is this not enough for Consumer Duty?

The FCA Wants the "Why," Not the "What"

COBS 9A requires firms only to recommend investments that are suitable for the client, taking into account the client's risk tolerance and ability to bear losses. But suitability isn't about stating what you've recommended. It's about demonstrating why that recommendation fits this specific client's circumstances, objectives, and risk profile.

The FCA doesn't just want to see "you are looking to have your money managed by a discretionary manager" in objectives, followed by "I have recommended this discretionary manager" in recommendations. This is never a client's objective.

Template-based systems produce exactly this problem. They fill in the blanks, but they don't build the narrative. They list facts without connecting them to suitability. They tell the "what" without ever explaining the "why."

That's where genuine AI separates itself from glorified templates.

The Architectural Advantage: How Emma Handles Suitability

Emma isn't a template software wearing an AI badge. She's purpose-built paraplanning software designed from the ground up to understand UK financial advice and deliver genuinely suitable recommendations.

Here's how the architecture works.

1. Foundation: Built on UK Regulatory Intelligence

Emma's compliance engine is mapped to COBS 9, 9A, and real outcomes from FCA-regulated documents. Finish the report? No, not just that. She understands what suitability means in practice.

Most paraplanning software treats compliance as an afterthought. Emma treats it as foundational intelligence. Every report she writes is informed by:

COBS 9/9A requirements for personal recommendations

Consumer Duty outcomes around fair value, consumer understanding, and support

Systematic ongoing suitability assessments

2. Context Integration: Assembling the Whole Picture

Templates work with single data sources. Emma works with everything.

When Emma writes a suitability report, she pulls live data from:

Meeting capture from Evie (AdvisoryAI's meeting assistant)

Fact-finds and CRM data

Investment statements and illustrations

Risk assessments and capacity-for-loss evaluations

Provider documentation

Then she does what no template system can: she cross-checks this information.

Emma identifies when a client's stated risk tolerance doesn't align with their capacity for loss. She flags when investment recommendations contradict stated objectives. She surfaces life events mentioned in meetings that impact financial planning.

She assembles a genuine suitability narrative by understanding how different pieces of client information connect. This is contextual intelligence.

3. Transparent Reasoning. No Black-Box Outcomes

Here's where Emma fundamentally differs from both templates and generic AI: every recommendation comes with clear, traceable reasoning.

For every recommendation Emma makes, she lays out:

What the recommendation is

Why it's suitable for this specific client

Why this option over alternatives

Every source has a citation. Every figure has a reference. Every statement links back to the original documentation.

This creates a clear audit trail for compliance and adviser confidence. When the FCA asks "how did you determine suitability?", you can point to exactly which client statements, risk assessments, and financial data informed each recommendation.

Generic AI invents plausible-sounding reasoning. ChatGPT can provide common reasons for recommendations, but it won't be able to ask your client what their aims and objectives are or create genuine links between goals and recommendations. Emma builds reasoning from actual client data and not on ‘This sounds reasonably probable’. It builds actual suitability that most AI suitability report generation fails at

Here’s a glimpse of Emma at work

Emma's Unique Features and USPs

What makes Emma different as paraplanning software? Let's get specific.

Firm-Specific Adaptation

Emma learns your firm's unique style. She's trained on your templates, your tone, your compliance requirements, and your house style from day one.

This means:

Reports emerge pre-formatted to your exact specifications

Your firm's voice carries through every document

No post-generation reformatting required (Almost zero)

Compliance preferences built in from the start

This isn't a generic template library where you pick "Option A" or "Option B." Emma understands your template as deeply as your best paraplanner does, replicating it precisely while filling in client-specific details.

And the best part? She gets better over time. Regenerate a section with specific feedback once, and Emma incorporates that learning into every future report. Unlike template systems that stay static, Emma dynamically evolves.

Templating That Adapts to Each Scenario

Here's something most AI tools get wrong: they treat every report the same way.

Simple annual review? Same structure as a complex pension transfer.

Emma's smarter than that. She's streamlined when the case is simple, robust when complexity demands it. The structure adapts to the advice scenario, not the other way around.

This means:

Shorter reports for straightforward cases (what Consumer Duty actually wants)

Comprehensive detail when complexity requires it

Scalable templates that flex with advice scenarios

With Consumer Duty's focus on consumer understanding, throwing everything into a report in the hope it covers your back can result in complaints being upheld because the client had too much information and couldn't understand the important parts.

Emma solves this by tailoring detail levels to suit the case. Clarity and brevity where appropriate, depth and analysis when necessary.

Multi-Document Intelligence Prevents Contradictory Information

Most paraplanning software works with one document at a time. Emma works with the entire case file simultaneously.

When Emma writes a report, she cross-references:

Current fact-finds against previous versions

Meeting notes against risk assessments

Investment illustrations against stated objectives

Provider documentation against client requirements

If she detects contradictions, say, a client's risk tolerance documented in one place conflicts with capacity for loss noted elsewhere, she surfaces it for adviser review.

This prevents the nightmare scenario where a suitability report contradicts information elsewhere in the client file. Emma ensures consistency across every document, creating a coherent advice narrative that survives FCA scrutiny.

Consumer Duty: Starts and Ends With It

Consumer Duty sets higher standards of consumer protection and requires firms to demonstrate they're delivering good outcomes for retail consumers. Emma was built ON this standard.

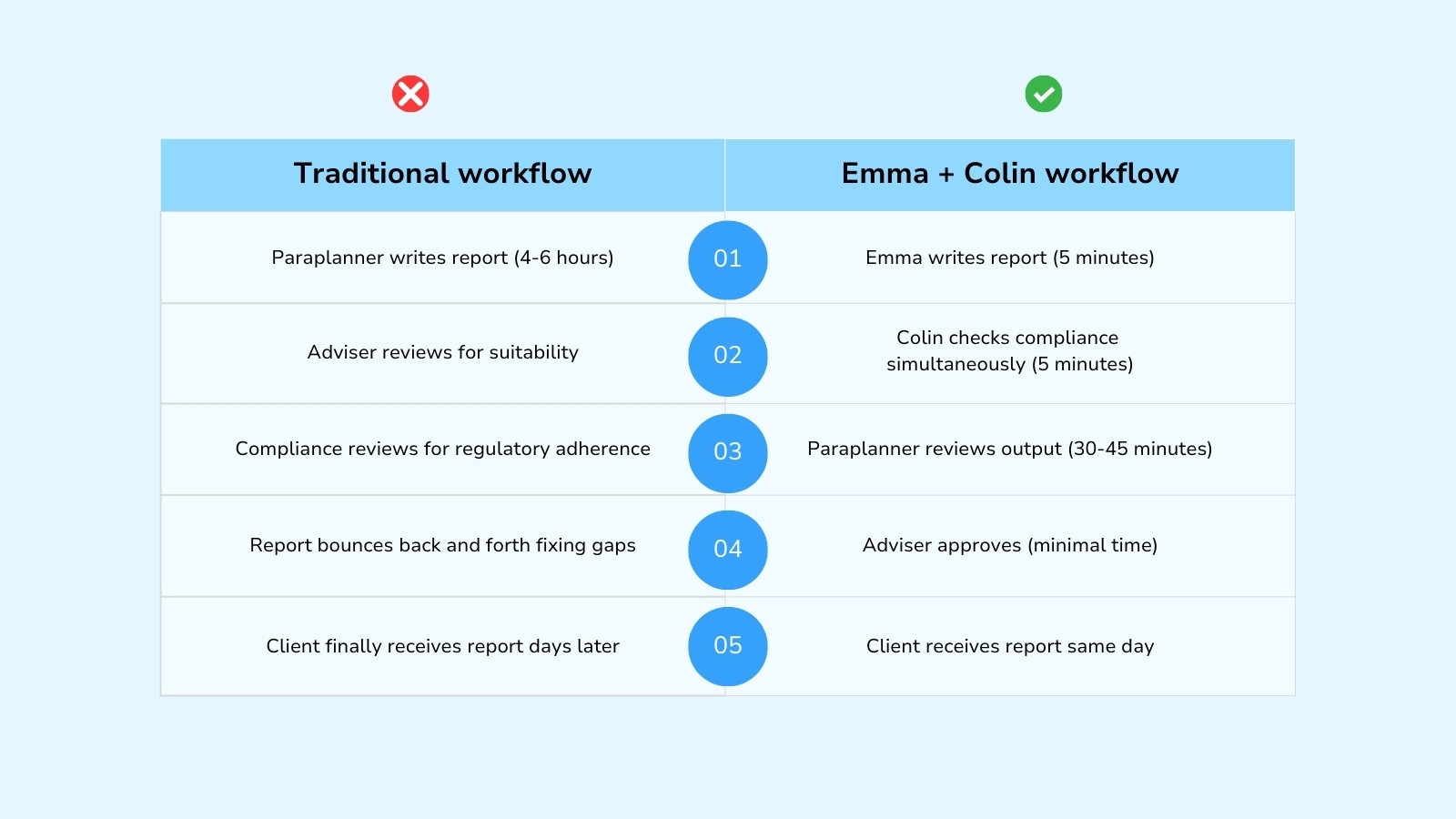

Colin Works Alongside to Check Everything

Emma doesn't work alone. She's part of the AdvisoryAI suite, working with Colin, the compliance-checking AI assistant.

Here's the workflow:

Emma writes the suitability report (5 minutes)

Colin performs a real-time compliance review (5 minutes)

Pass/fail verdicts with actionable fixes delivered instantly

Paraplanner reviews and approves (30-45 minutes)

Colin checks:

Raw documents and initial documentation (not just finished reports)

Compliance against COBS 9/9A

Consumer Duty requirements for fair value, consumer understanding, and support

FCA Handbook standards

Colin flags compliance issues and suggests corrective edits instantly, breaking down compliance into clear categories. Every checkpoint gets a pass/fail verdict with tailored guidance on fixes.

If you want to know more about Colin, click here.

Clarity, Price/Value Transparency, and Explicit Support Documented

Consumer Duty requires firms to ensure clients get the information they need at the right time in a way they can understand, that the price clients pay is reasonable compared to the benefits, and that clients get the right support when needed.

Emma builds this directly into the report structure:

Clear, jargon-free language that clients actually understand

Transparent fee breakdowns showing what clients pay and why

Explicit value demonstrations linking advice to outcomes

Risk warnings and downsides are prominently displayed

How Emma Builds Consistency in Fair Value Assessments

Fair value isn't a one-time calculation. It's an ongoing demonstration that advice benefits justify fees charged.

Emma creates consistency by:

Documenting advice value in every report

Linking recommendations explicitly to client outcomes

Tracking how advice evolves to meet changing circumstances

Ensuring fee transparency across all client communications

This consistency matters. The FCA expects firms to have the right culture and governance to meet heightened Consumer Duty expectations, with responsibilities for outcomes owned across the organisation. When every report Emma writes maintains the same standards for fair value documentation, your firm demonstrates systematic compliance.

Handling the Real Cases and Messy Data

Perfect client files don't exist. Real advice involves incomplete information, contradictory statements, and ambiguous objectives.

Emma's built for this reality.

Emma Surfaces Contradictions for Adviser Review

When Emma detects misalignment like risk tolerance versus capacity for loss, stated objectives versus recommended solutions, current circumstances versus historical data, she flags these contradictions and asks for adviser input.

This creates a critical safety layer. Emma accelerates report writing, but she never removes professional judgement from the process. She highlights where human expertise is needed, ensuring reports aren't just fast, they're accurate and defensible.

Handles Updates and Ambiguities

Client circumstances change. Documentation gets updated. New information emerges mid-advice process.

Template systems struggle with this. They're built for static data, not evolving advice journeys.

Emma handles updates dynamically. Upload an amended fact-find mid-process? Emma incorporates changes seamlessly. Client clarifies an objective during a follow-up meeting? Emma adjusts recommendations accordingly.

This isn't "set-and-forget" paraplanning software. This is adaptive intelligence that works with the messy reality of ongoing advice relationships.

Why hear from just us? Look at the advice firms & awards endorsing us.

LIFT-Financial Group reported:

"It's the first real-world proof of concept we've seen for AI for a bespoke business use case. Exciting times!"

- Jonathan Stubbs, LIFT-Financial Group

AdvisoryAI also won the Best in Show at the Empowering Advice Through Technology (EATT) event in both 2024 and 2025, proving real-world impact in live advice workflows.

And FYI, firms using Emma have doubled client load within six months without hiring additional paraplanners.

Emma + Colin: The Perfectionist Duo

Here's what separates Emma from every other paraplanning software: she doesn't work in isolation.

The integration of real-time compliance review means Emma's reports are both accurate and ready on first pass. Not "mostly compliant pending review." Actually compliant, with evidence to prove it.

This changes the adviser-paraplanner dynamic entirely.

Advisers Focus on Value, Not Fixing Regulatory Gaps

Advisers spend time on strategic client conversations. Paraplanners focus on complex technical analysis. Compliance teams audit with confidence, knowing systematic checks happened at every stage.

Proven Suitability Efficiency

Recent research shows 94% of paraplanners have experienced increased workload due to regulatory change, with 22% now using AI as part of core processes to manage these pressures. 40% of paraplanners are optimistic about AI, viewing it as an opportunity to enhance efficiency.

Emma delivers on this promise and the will to efficiently adapt.

The pattern is clear: firms using Emma as their paraplanning AI assistant aren't just working faster. They're working better, producing higher-quality outputs with stronger compliance and greater client focus.

"Emma has revolutionised our reporting process at Bluecoat, enabling us to generate 10 annual review reports and 8 VCT suitability reports in just 30 days – a task that previously consumed significant adviser time. What used to take 4-6 hours per report now takes less than an hour, while maintaining comprehensive coverage of risk profiles, investment recommendations, and client-specific financial planning elements.”

Baris Furlonger

Chartered Financial Planner, Bluecoat Wealth Management

Emma Sets a New Standard for Advice Suitability

The FCA continues prioritising Consumer Duty implementation through 2025/2026, conducting multi-firm reviews on how firms embed the Duty and working to clarify expectations around product design and consumer outcomes.

In this environment, paraplanning software that merely speeds up template completion isn't enough. You need intelligence that's defensible against advice documentation.

Emma is a paraplanning software built to make suitable advice scalable without sacrificing quality, compliance, or client outcomes.

The firms winning in 2025 aren't working harder. They're working with AI assistants like Emma, who understand that every client deserves genuinely personalised suitability.

Ready to See How Emma Transforms Suitability Report Writing?

If you're ready to see how Emma turns suitability reports and more from a 4-6 hour slog into a 20-minute workflow without compromising quality, compliance, or personalisation, reach out to us and experience paraplanning software built for the advice you actually give.

BOOK A DEMO