Beyond Basic AI: How UK Financial Advisers Are Automating Bespoke Client Documentation

Author

Alan Gurung

Published

Dec 12, 2024

Read time

10 min

No matter what business or organisation someone is running, the key to success is properly managing and strategising their finances. The financial services industry has witnessed rapid change in recent years. Amidst increasing regulatory demands, rising client expectations, and the growing complexity of data management, advisers like James are under more pressure than ever to deliver high-quality, compliant reports.

James, like many in the profession, entered the financial advice industry with a clear vision—to make a difference in people's lives through sound financial advice. But as his client base grew, so did the workload. The days became filled with managing client meetings, reviewing portfolios, and dealing with the increasing volume of administrative tasks, leaving little to no space for scalability. Despite his best efforts, the increasing demand for detailed reports, compliance checks, and data analysis meant that James found himself with less time for strategic planning and client engagement—areas that not only ignited his passion but also required his full attention to ensure his clients received the best possible advice.

For James, like many financial advisers, the challenge was clear: with more clients comes more work. He often wondered: should he hire a paraplanner to manage the workload, or outsource paraplanning services? What if there was a smarter solution to streamline the process, reduce delays, and focus more on what truly mattered—building relationships and delivering meaningful advice?

This is where generative and interactive AI steps in as a supportive ally for financial advisers like James. In recent years, industries have embraced AI to unlock new levels of efficiency, and the fast-paced, complex financial sector is leading the charge. Once viewed merely as a tool for basic automation is revolutionising how businesses operate, delivering unparalleled intelligence and streamlining day-to-day processes with remarkable precision.

In the financial sector, AI’s potential to reshape the way firms work has become undeniable. No longer limited to performing basic tasks, AI is being used to analyse complex data sets, identify patterns, and deliver real-time insights that empower better decision-making. It's enabling financial institutions to streamline client management, improve accuracy in reporting, and reduce the time spent on administrative tasks. The integration of AI into financial workflows has freed up human expertise to focus on higher-value activities—while minimising human error and maintaining compliance. This shift is not just about keeping up with the competition; it’s about gaining a competitive edge, pushing boundaries, and setting a new standard for how the industry operates.

The Evolution of AI in Financial Services

AI has rapidly evolved within the financial services sector, shifting from simple automation to addressing complex challenges. In the financial advice industry, AI now supports intricate functions like managing client documentation, streamlining meeting notes, and generating detailed reports. Beyond just automating tasks, AI enables precise data analysis, enhancing client interactions and improving the accuracy of suitability reports.

AI’s role extends into legal frameworks, particularly within financial services. It is revolutionising risk management and compliance by automating contract analysis to ensure adherence to ever-changing regulatory standards. AI tools interpret vast amounts of legal documentation, helping assess risks in financial transactions, mergers, and acquisitions. Real-time compliance monitoring and regulatory updates allow advisory firms to stay ahead of new laws and regulations.

AI is now essential in both advisory and legal contexts, enabling firms to focus on higher-value client interactions while ensuring operational efficiency and compliance. This marks a new era of precision, where AI supports firms as they navigate the complexities of both legal requirements and client needs.

The Ideal AI Scenario in Financial Advice

What if technology could transform financial advice from a complex process into something as simple as a few clicks? Imagine an intelligent system that not only understands the nuances of financial terminology but is also fluent in your specific formats and templates. A system that can navigate the often-cluttered world of data, while being both interactive and user-friendly—this, we believe, is the ideal AI scenario for the financial advice sector.

At AdvisoryAI, our vision is to simplify the financial advice process, and Emma, our AI assistant, is at the heart of this mission. Designed to empower financial advisers like James, Emma goes beyond being a tool—it's a transformative partner that automates mundane tasks, enhances accuracy, and brings efficiency to the forefront. With regular updates, including advancements in automating regulatory adherence, Emma continues to evolve, driven by our commitment to innovation.

We strive for a future where technology doesn’t just assist but truly understands, and with Emma, that future is becoming a reality. Discover how Emma is reshaping paraplanning in our blog.

The Current Paraplanning Scenario

The financial industry is under constant pressure to deliver detailed, compliant, and client-specific reports—accurately and promptly. For paraplanners, the process can be:

Delays in Receiving Meeting Notes

Advisers often take time to share meeting notes from client meetings, which can delay the preparation of suitability or annual review reports.

Time-Consuming Tasks

Reading lengthy documents, summarising data, and formatting reports can consume hours each day.

Limited Time for Value-Added Activities

With so much time spent on repetitive tasks, strategic planning, and client interactions often take a backseat.

Redefining Financial Reporting With Emma

At AdvisoryAI, we understand the evolving needs of financial advisers and paraplanners, particularly when it comes to managing the complexities of financial report generation. Emma, our AI assistant, was designed to support paraplanners and advisers in delivering high-quality suitability reports, annual reviews, and other financial documents with precision and ease, allowing them to focus on strategic decision-making and client engagement.

Emma doesn’t just automate tasks; it empowers paraplanners and advisers by offering dynamic, real-time customisation of reports, ensuring the flexibility and accuracy required for a variety of client needs. Here’s how Emma is transforming paraplanning:

Streamlined Automation

Upload any document type—whether it's a scanned copy, PDF, Word Doc, or provider file—and Emma will seamlessly analyse, extract, and organise the information into structured, compliant reports like suitability reports and annual reviews. Tasks that once took hours now take minutes.More Than Just Meeting Notes

While many AI tools in the advice sector focus primarily on meeting notes, Emma goes far beyond that. Emma supports the generation of suitability reports, annual reviews, and more, offering a complete suite of reports that paraplanners and advisers need. This breadth of functionality ensures you’re not limited to just one type of document, helping to streamline the entire reporting process.

Adaptable to Bespoke Templates

Emma is fully adaptable to the firm’s specific needs. When AdvisoryAI onboards a client, we work closely with the firm to integrate their unique templates into Emma’s framework. This allows Emma to generate reports that are perfectly aligned with the firm’s custom structures and advising styles, ensuring both compliance and consistency across all documents. This automated adaptation saves at least 50% of the time.

Interactive Customisation

One of Emma's most impressive features is its ability to interact. Unlike traditional AI systems that are static, Emma allows for dynamic, real-time edits. Imagine this: after generating a report, you realise a few sections need tweaking. Instead of manually adjusting each section, you can simply communicate directly with Emma.

Message Emma: What Does This Look Like in Practice?

Imagine having a digital assistant for financial reports that listens, learns, and adapts instantly. Meet Message Emma. Whether it’s tweaking risk assessments, simplifying complex paragraphs, or tailoring recommendations, Emma does it all with a simple prompt. Built for financial professionals, it ensures compliance, integrates seamlessly with CRMs, and frees up hours for you to focus on what really matters—your clients. With Emma, it's not just automation; it’s precision and partnership at your fingertips.

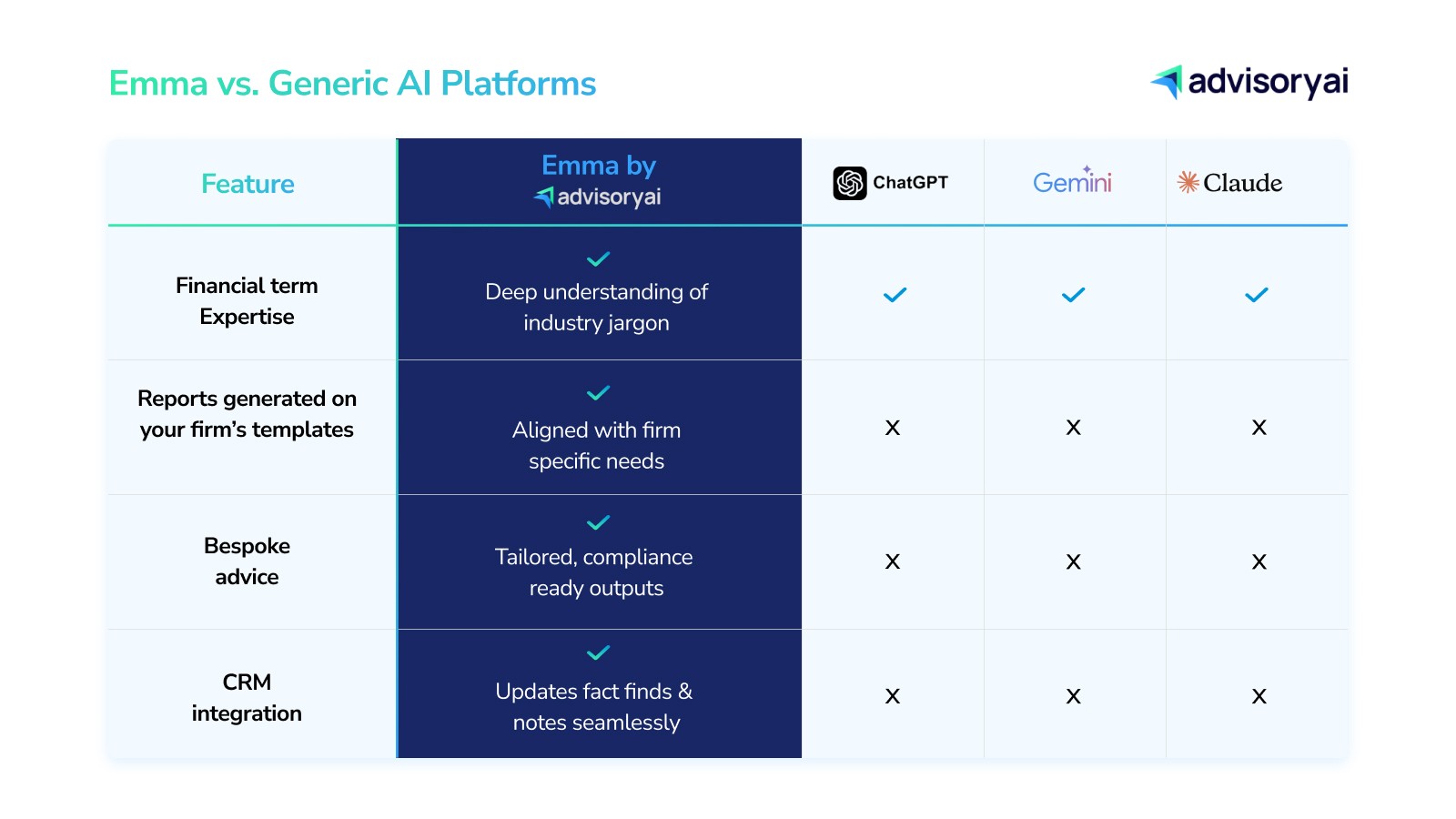

Emma vs. Generic AI Platforms: A Distinctive Approach

You may wonder, 'Why not use free generative or interactive AI instead of Emma?' And to answer your question, here's why Emma stands apart as the ideal choice for the financial advisory sector.

AdvisoryAI’s Emma is designed exclusively for financial services, making it distinct from general AI tools like ChatGPT, Gemini, or Claude. Emma specialises in understanding financial terms, interpreting complex data, and generating bespoke reports tailored to your firm’s requirements.

While other tools are generalists, Emma is a financial services specialist, delivering outputs that are not only accurate but also tailored to meet compliance and client expectations.

The Technology and Learning Process Behind Emma

Emma is built for and by financial advisers, with two years of dedicated training on financial data. This means Emma’s algorithms are specifically designed to meet the unique needs of financial advisers and paraplanners, providing tailored solutions for report automation, compliance, and client management.

The system’s data is securely stored in AWS S3, hosted on UK-based servers, ensuring high security and reliability. Importantly, Emma does not use a firm's data to train the overall model but rather to enhance its own bespoke model, refining its performance for each specific firm. This means the more a firm uses Emma, the better it becomes at adapting to their unique needs, improving over time.

This continuous learning process ensures that the model remains highly relevant and efficient, offering personalised insights and automation that evolve alongside the firm’s requirements.

Real-World Results: Emma in Action

Finsource Partners’ experience highlights the transformative power of Emma. Their journey illustrates the tangible impact of intelligent automation:

"With the Letter of Authorisation (LOA) pack summary from AdvisoryAI, it took me less than an hour for 10 reports, compared to what would normally take over 3 hours. That's a saving of over 2 hours which allows me to get on with other things that I would otherwise not have been able to do."

— Jolene Glennon, Founder & Director, Finsource Partners

Conclusion: The Future of Financial Reporting is Here

As financial landscapes become increasingly complex, the integration of AI is no longer a competitive advantage; it's a strategic necessity. The convergence of advanced machine learning, natural language processing, and domain-specific training represents the future of financial reporting. By transforming repetitive tasks into intelligent, adaptive processes, AI enables financial professionals to focus on what truly matters: building and maintaining robust client relationships.

Emma isn’t just an AI assistant; it’s a game-changer for financial advisers and paraplanners who want to work smarter, not harder. Try Emma today and see how it can revolutionise the way you work.

BOOK A DEMO