How adding AdvisoryAI to workflows saves time and augments growth

Author

Alan Gurung

Published

Jul 2, 2024

Read time

4 min

The UK financial advice market is at a very interesting juncture. The industry is facing a challenge of excessive service demand, which means that there is room for exponentially growing the client base per adviser. As per IFA magazine, the FCA numbers show that between 2017 and 2022, 1.1 million new ongoing clients have been added at advisory firms vs only 3000 new financial advisers at these firms.

In fact, FTAdviser states that one in five UK adults with stock-market related investments, have struggled to find a suitable advisor for their needs. Two of the top three reasons for this are -

The advice provided post first meeting was not of a high quality

The advisers were simply too busy to onboard new clients

A wake-up call to augment growth

The reality check that new business is being rejected by advisers or not being on boarded due to the amount of work personalised advice requires is something that most advisory firms have been quick to realise. While steps have been taken to onboard technology-driven solutions such CRMs, video conferencing solutions, email automation etc. to mitigate challenges with productivity. Yet, the gap to secure more clientele remains large.

So, the question then lies, where are financial advisers wasting their time?

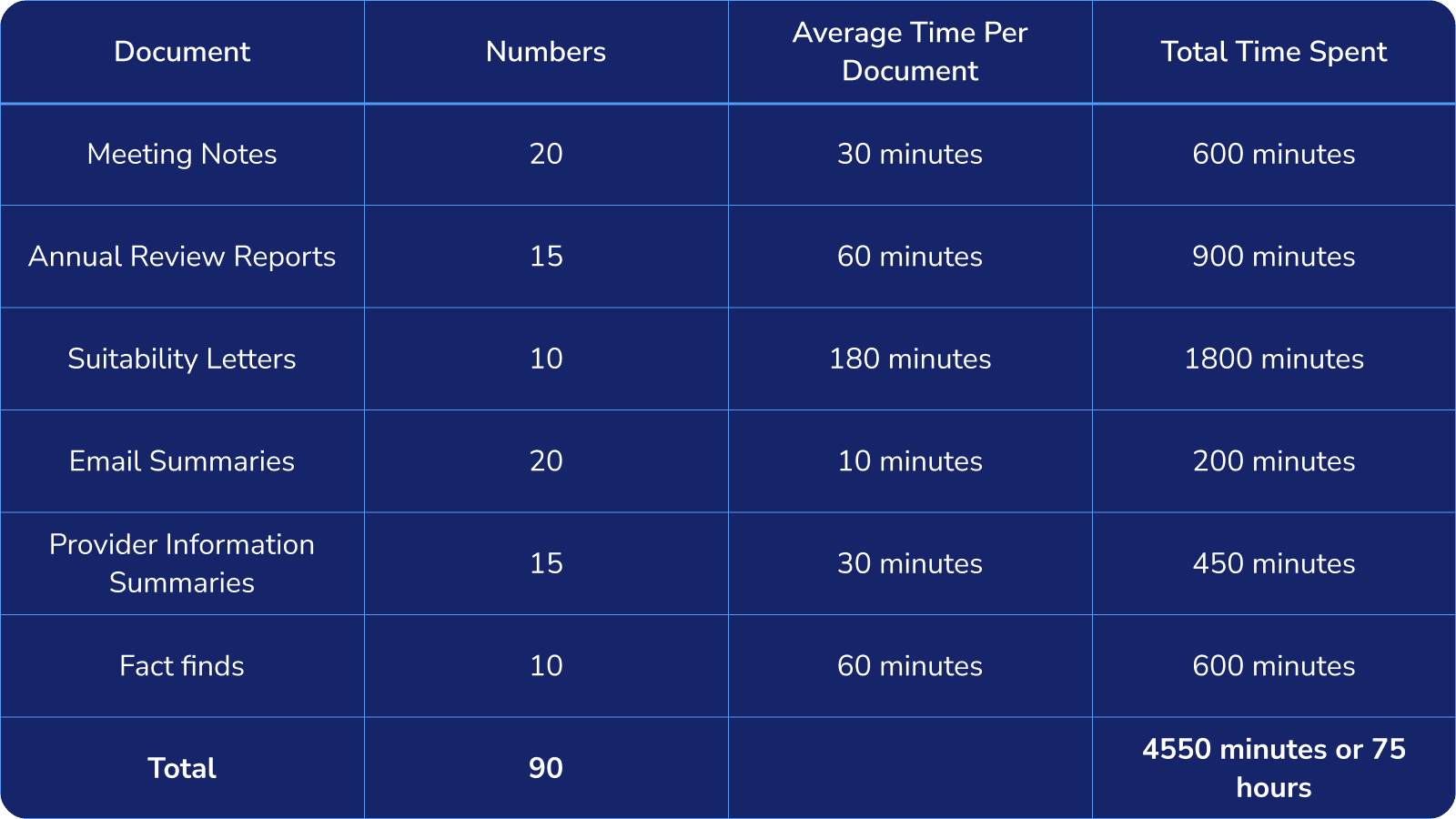

Time spent on admin tasks by a financial advisor: A breakdown

The average financial advisor in the UK has about a 100 clients. Let’s say, he/she needs to service at least 30 of them in a month. To provide quality service to these clients, an advisor would create the following documents in any given month and also spend a significant amount of time doing so -

The average financial advisor spends roughly 75 hours a month or almost 4 hours a day on admin tasks that is not directly generating revenue for the company. This also means that almost half the time is spent per month on administrative tasks, which could be spent in providing more quality client service and in onboarding more clients.

AdvisoryAI: The ultimate solution to put admin tasks on auto-mode

Since the release of ChatGPT and the rise of generative AI, the way companies operate has significantly transformed. Automation across industries has vastly increased, with more businesses adopting an AI-first approach in their technology implementations. For financial advisers, the most obvious and beneficial AI solution would be one that saves them time on administrative tasks.

However, generative AI solutions have traditionally struggled to provide financial advice or create the various documents financial advisers need without understanding the full context. They weren't specifically trained to meet the unique needs of financial advisers. AdvisoryAI has addressed this issue by developing an AI-powered platform tailored to financial advisers' needs. Trained with advisor data, it can offer personalised advice and generate necessary documents.

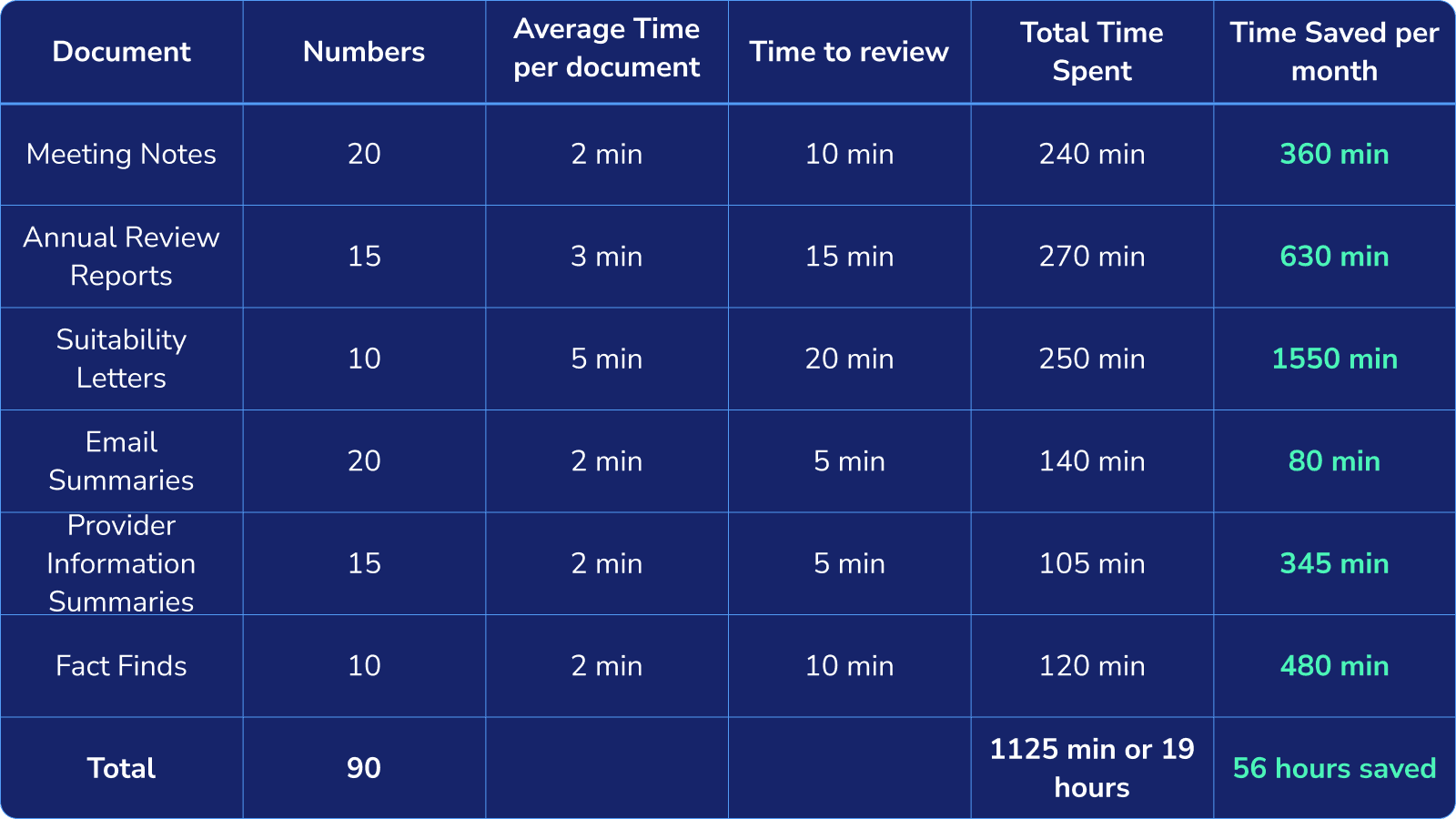

AdvisoryAI processes all the documents that financial advisers upload, learning from this input much like how a human would absorb information. The key difference is that AdvisoryAI can generate these documents in just a few minutes—none taking more than five minutes—a feat impossible for humans. We recommend that advisers and paraplanners review the generated documents before sharing them for further processing, ensuring accuracy and appropriateness.

Let’s re-create the above table once more to understand how much time it would now take a financial advisor to create the same documents with AdvisoryAI. We will also factor in the average time spent reviewing each document.

This means that any advisor can save over 50 hours by using AdvisoryAI every month, reducing their time spent on administrative tasks to just 19-20 hours monthly, or about 45 minutes per business day.

These numbers are subjective to the number of clients advisers have in their client base.

Add personalisation to client engagements

Integrating AdvisoryAI into daily workflows allows financial advisers to save a substantial amount of time, enabling them to focus more on servicing current clients and onboarding new ones. AdvisoryAI swiftly processes all uploaded data and personalises the advice to meet each client's specific requirements.

AdvisoryAI goes beyond merely generating documents based on available information; it provides tailored recommendations that comprehensively address clients' needs. As advisers review documents, AdvisoryAI learns from the modifications, gradually emulating their writing style and making adjustments accordingly. These personalised touches make AdvisoryAI a highly sought-after solution in the advisory industry today.

Ready to Transform Your Practice?

With AdvisoryAI, automating Meeting Notes, Provider Information Summaries, Suitability Letters, and Annual Review Reports is quick and easy. Each document is generated in under five minutes.

Experience the difference for yourself. Sign up for a trial today and discover how AdvisoryAI can streamline your processes and enhance client relationships.

BOOK A DEMO